Methods factors noswitch na edit the information in columns b through g. Download this plug and play template to produce your own schedule for amortizing items on a financial model you can enter your own numbers or formulas to auto populate output numbers.

An accountant uses depreciation schedule template that is pre made or a depreciation schedule excel document they make on their own.

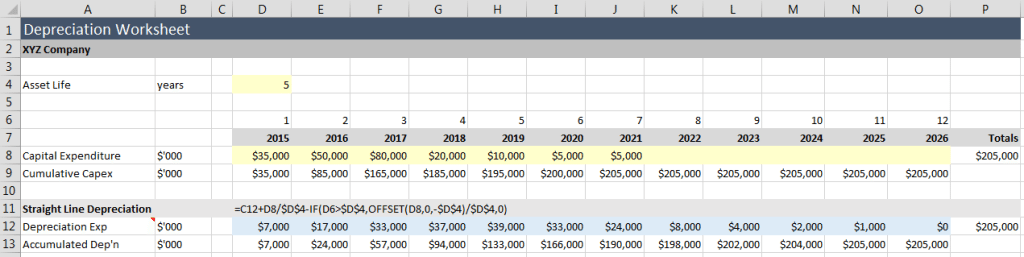

Depreciation schedule excel template. Depreciation is the process of calculating the reduction in the value of as asset each year during its use until its face value turn out to be zero. Depreciation schedule calculator excel. These templates are perfect for creating financial reports related to small and mid sized businesses.

Fixed asset record with depreciation keep track of your equipment and other fixed assets with this accessible spreadsheet template. For instance you bought a computer system in 2017 for 5000. Depreciation schedule templates are perfect for listing multiple assets while offering the option to select different depreciation methods for the purpose.

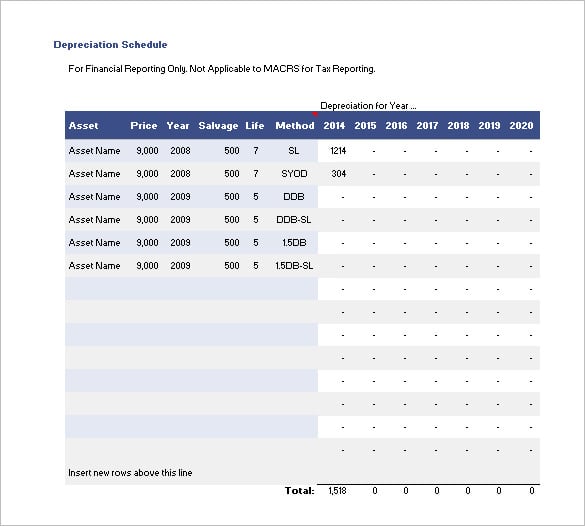

Consider a particular depreciation method and start making of depreciation schedule with help of depreciation schedule template. Record the asset details including serial number physical location and purchase information and depreciation will be calculated for you based upon straight line 150 declining balance and 200 declining balance methods. Depreciation for year asset price year salvage life method asset name sl syod ddb ddb sl 15db 15db sl insert new rows above this line total.

See the link above for more information about using this template. 200 200 150 150 200800 200900 100 201000 201100. Depreciation is something that you can get a deduction for in the current year even though you might not have spent money to buy it in that year.

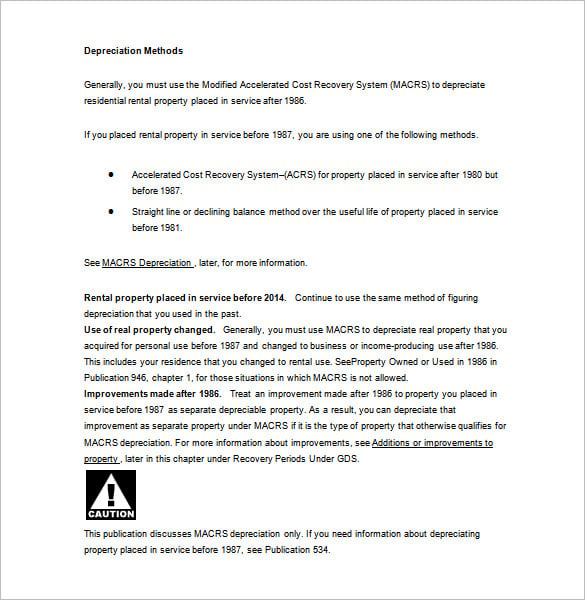

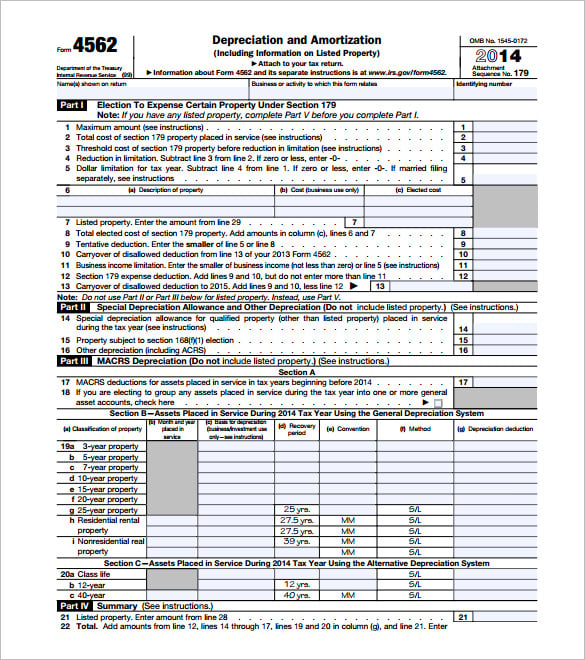

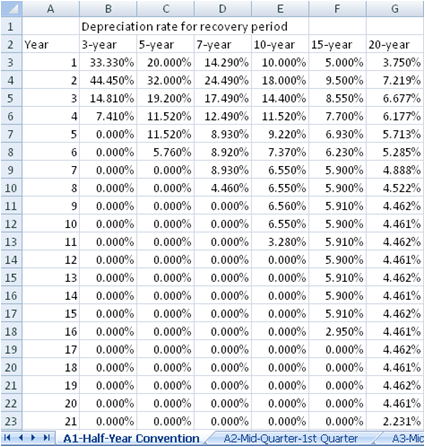

This template is designed to help accountants and other financial professionals calculate tax depreciation for assets that fall under modified accelerated cost recovery system macrs rules. The template calculates both 5 year depreciation and 7 year depreciation. They track the amount a business claims for deduction each year.

A depreciation schedule template is used to create depreciation schedules that are widely used in the business world for tracking accounting records because a financial statement of a business is based on the total value of assets and total accumulated amount of depreciation. This depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Description by patrick curtis this is wall street oasis free amortization schedule model.

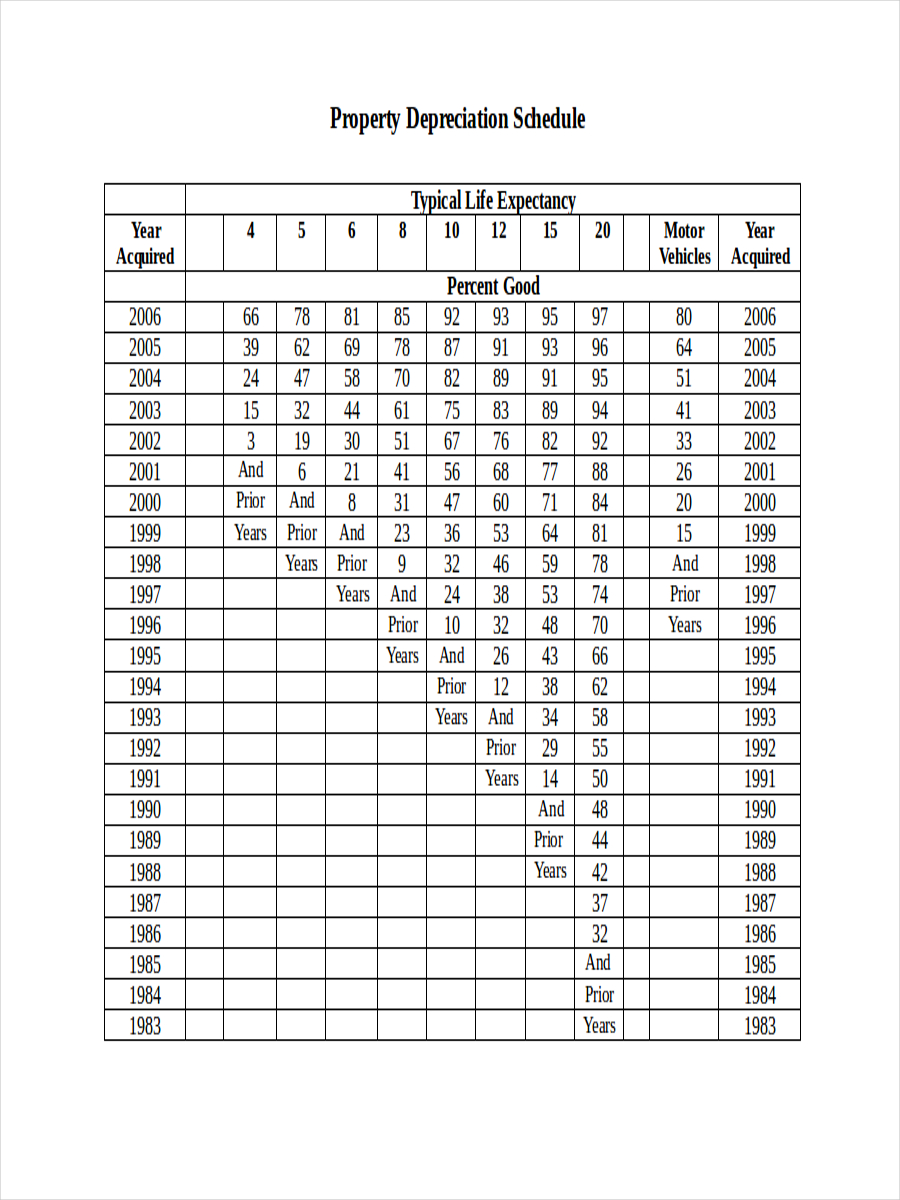

For each asset choose between the straight line sum of years digits double declining balance or declining balance with switch to straight line. Every asset that qualifies for the depreciation deduction is predetermined and in a set class. Business settings and companies use different methods for depreciation and they also use depreciation schedule to keep track of depreciation for different assets and equipment.

/asset-depreciation-f2081ee6e859438a9bab1c53ec254f3f.jpg)

0 Response to "Depreciation Schedule Excel Template"

Post a Comment