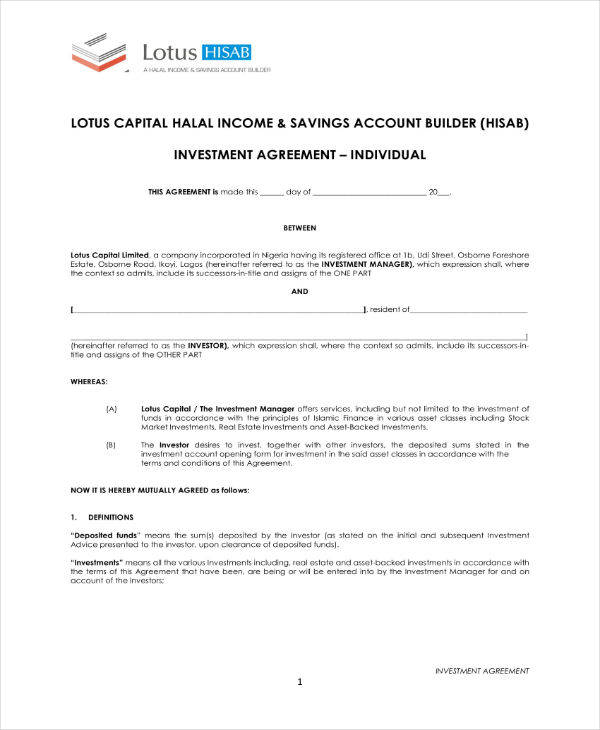

Founder 1s stock shares at founder 1s investment. Equity generally refers to an ownership interest in a business enterprise can be thought of as the value remaining after all of the companys debts and liabilities are paid off aka equity value or residual value often used to refer to stock or membership units that represent an ownership interest in a company ie.

When you get a major investor or start generating enough cash flow to pay people you can calculate the equity issue official shares sign a shareholders agreement and be on your way.

Dynamic equity split agreement template pdf. Traditional equity splits rely on the ability to predict the future. This is why its called a dynamic split. Raz is right pick partners you can trust.

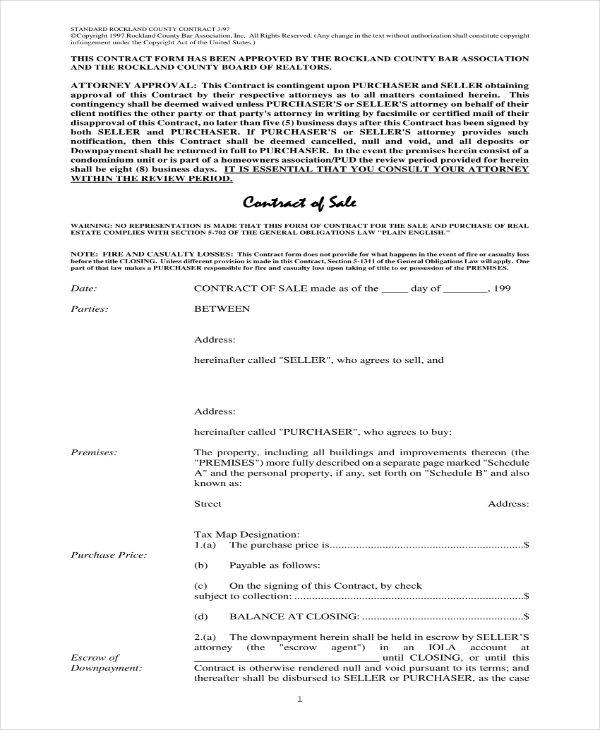

Dynamic equity split agreement template as the kind of workplace agreement and the rules which apply vary its a fantastic concept to utilize your state farming organisation or legal advisor to assist you compose an agreement that is beneficial and appropriate. A dynamic equity split model is by far the most rational way to divide up equity and in spite of what some of the other answers say it can be implemented quite easily with limited tax consequences and without a stack of agreements and contracts. During the term of this agreement title to the property will be held in the name of occupant.

Dynamic equity splits slicing pie outlines a straightforward process for implementing a dynamic equity split in an early stage startup to ensure the most fair equity split possible. This is impossible and therefore the split will be wrong. The term of this agreement shall commence on the date escrow closes on occupants acquisition of the property and shall continue until terminated in accordance with the provisions of section 63 of this agreement.

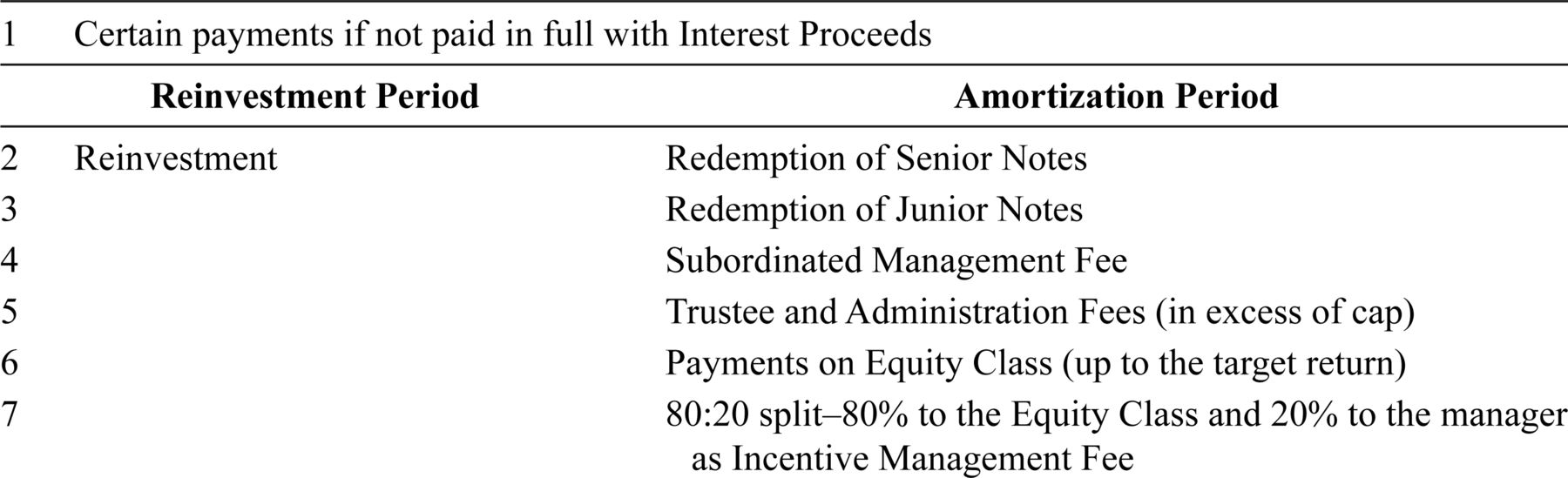

To master startup founder equity agreements industry leading cofounders consider the following factors. Valuation and equity split the founders hereby agree to divide shares of company as follows resulting in a total current valuation of valuation. A vesting schedule specifies when and how co founders can exercise the stock options awarded in the equity split agreement.

It is ideal for bootstrapped startups where time is the primary contribution of founders but it will. In fact between growing the company finding funding hiring and more equity is the last thing cofounders want to think about. This means that over time the potential equity split will change depending on what someone contributes.

A dynamic model on the other hand is based on what actually happens. Vesting does little to mitigate the issue. A typical vesting schedule allows for incremental vesting over a four or five year period with a large portion of options vesting at the end of the first year.

However the most successful tech startup cofounders agree on equity split right from the beginning. It provides a concrete definitive unambiguous split that will always be fair.

0 Response to "Dynamic Equity Split Agreement Template Pdf"

Post a Comment