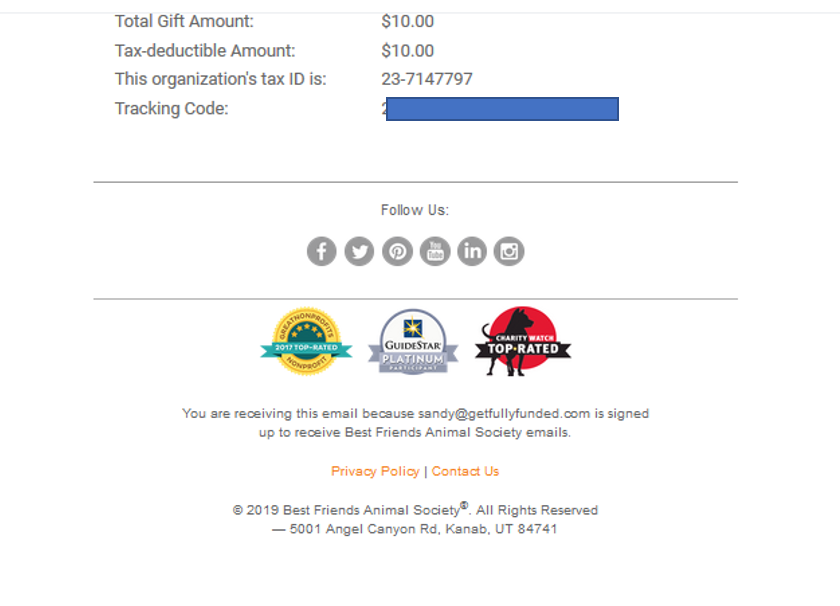

Most at times these receipts are emails or letters directed to supporters once donations are made. How to create a 501c3 compliant receipt using donorbox.

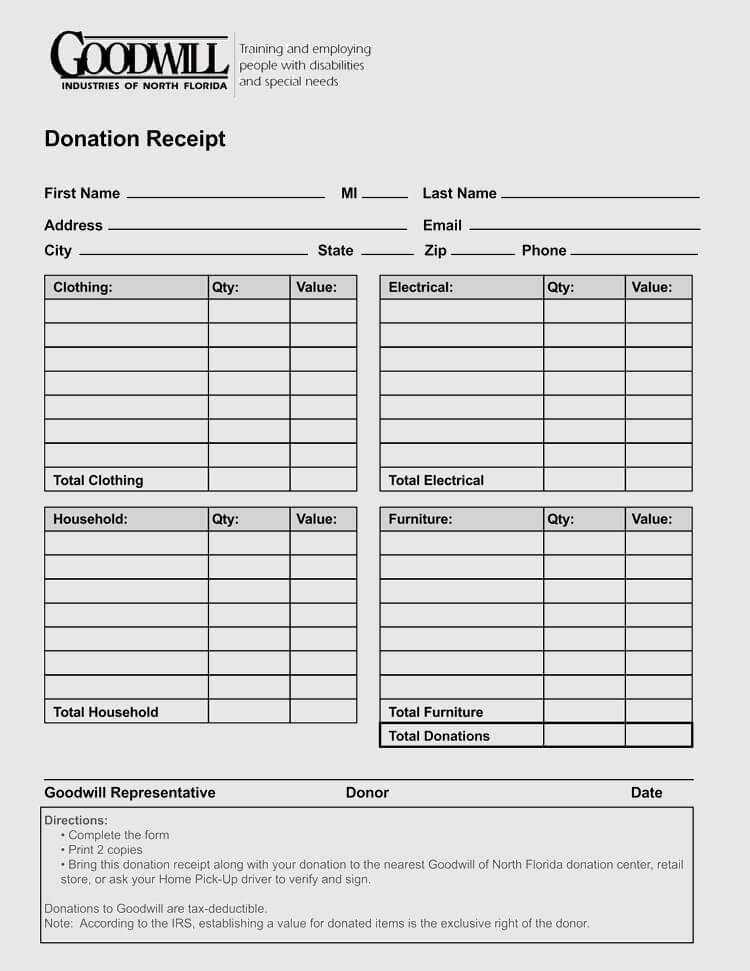

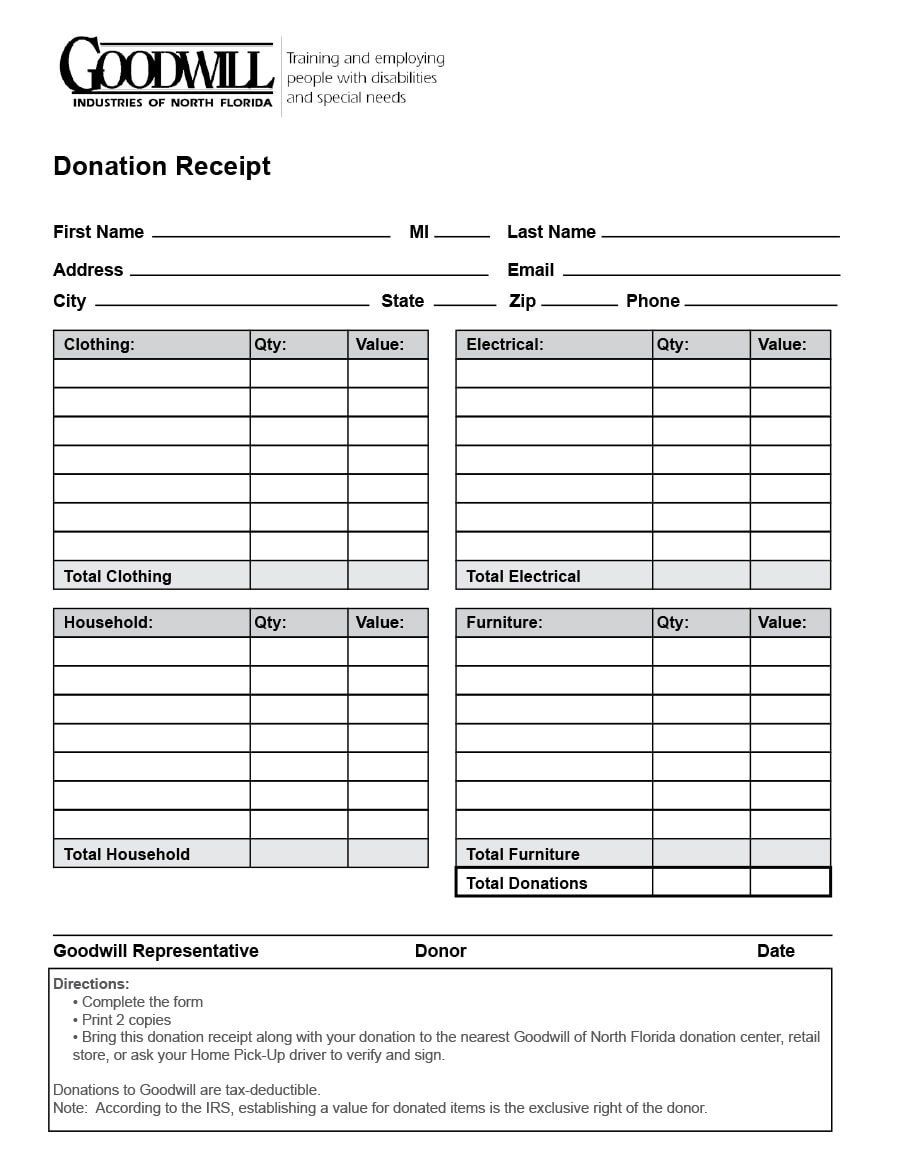

The templates were designed with word and excel which makes the templates easy to customize with your own organizational details logo and more.

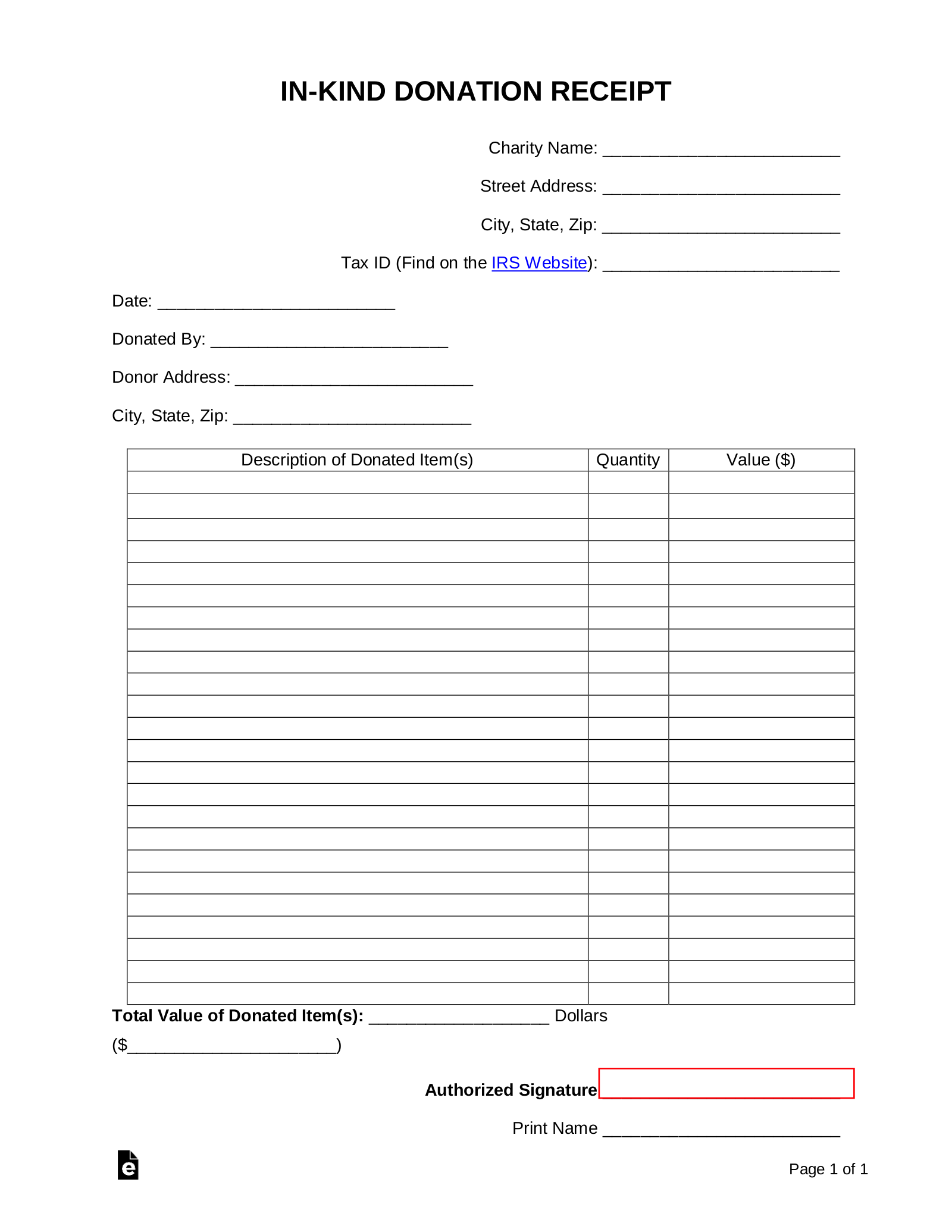

Donation slip sample. The donation receipt template is very easy to use. Donation receipt is an important slip that acts as proof of donation by the donor to the recipient. Donation receipt stands for the proof that a contribution either in kind or monetary was given to an organization by a certain donor.

The cash donation receipt assists in proving the authenticity of the transaction to the government should the donor wish to deduct the contribution from their total income. Using a donation receipt template. These donation receipt template slips are beneficial for donor as well as the recipient.

A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. It consists of amount of donation date and donors information.

Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. Donation receipts in doc format. For most nonprofits organizations the receipts are sent within the year of the donation or the beginning.

Make sure to save your donation receipt template so you can make use of the same template for all your donations. If you dont see a cash receipt design or category that you want please take a moment to let us know what you are looking for. Organizations using donorbox our powerful and effective donation software can very easily generate 501c3 compliant tax receiptsthis includes both receipts for every individual donation and consolidated receipts of the entire year of donations.

Simply select the template desired. Also make a copy and file all the donation receipts which you have given out to keep track of all the donations and for tax purposes as well. How to create a donation receipt.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. Because charitable donations are tax deductible for the donor and reportable by the nonprofit organization a donation receipt must include specific information about the value of the donation and what the.

0 Response to "Donation Slip Sample"

Post a Comment